- +91 9261 2110 03

- ptaimp@gmail.com

- Mon - Sat: 8:00 - 20:00

100% Customized Wealth Management Program that Works Best for You.

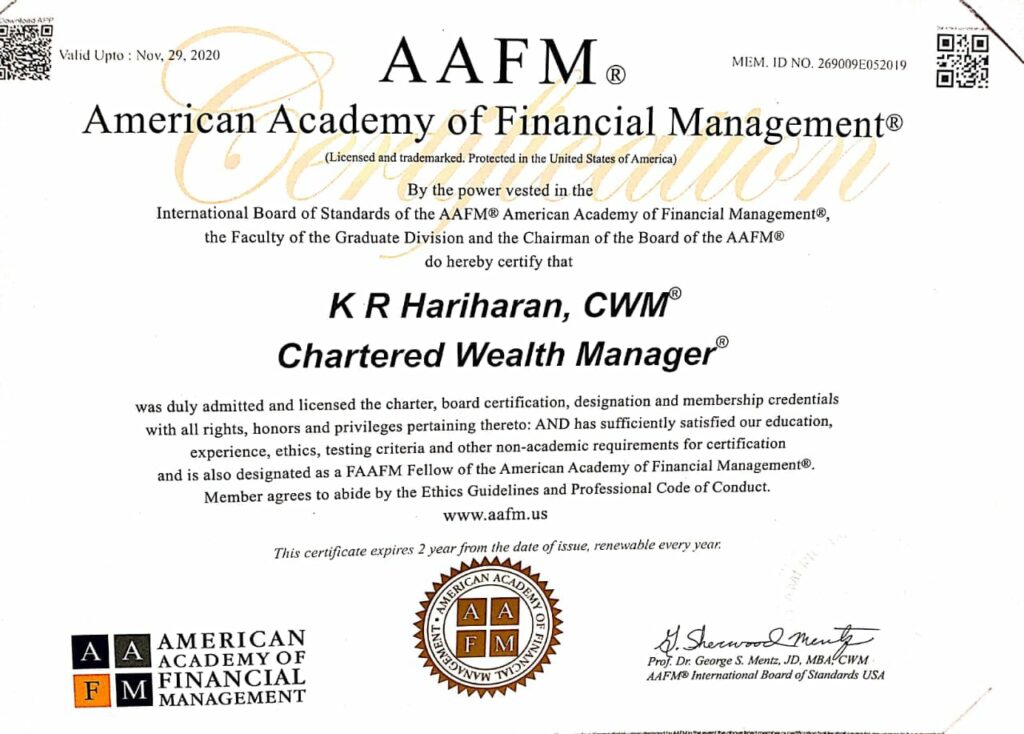

AAFM Registered Partner Code : 10020203

The Chartered Wealth Manager accreditation is recognized as the top certification in Wealth Management and Private Banking globally and serves as a standard of expertise in the Finance career. Financial planning, Real estate and trusts, Asset finance, Portfolio construction, International taxation, Retirement law, Economic history, Investment opportunities, Funds and money transfers, Rising net worth consulting, Customer engagement, adherence, and morality, Corporate entities & organizations, Threat and insurance, and other financial topics must be covered by Chartered Wealth Management professionals.

This course teaches how professional wealth managers create strategies based on their customers’ risk tolerance level, individual conditions, and long-term financial plans offered by Best CWM Course Training Institute in Hyderabad. A CWM, for example, can construct a stock portfolio of high producing dividend equities for an investor seeking additional income. A CWM analyses vast quantities of stock prices and statistics and gives a fair and balanced evaluation of the information to clients. A CWM can advise a client not to invest after reviewing the documentation for an anticipated initial public offering (IPO).

Rohan Sharma (Founder Professional Training Academy)

Qualification : (ACS, CFP, CMT Coach and SEBI – Registered Research Analyst, Investment Advisor)

Specialization: Technical Analyst, Financial Planning, Option Strategy Analyst, Portfolio Management.

Experience: He has successfully operated a Financial Markets Training Academy for the past 11 years. Get expertise in equity, commodity, currency, derivatives, option strategies, portfolio management services, and about working in broking houses, as well as discover corporate broking firms’ requirements from their workers. He has pushed the Professional Training Academy as a solid information platform for those interested in gaining in-depth knowledge and beginning a career in the Capital Market. He is now a resource person for the NSE, FPSB India, Morgan International, and the IIBF. He often serves the Zee Business and CNBC TV Awaaz analyst panels.

A Wealth Manager is a professional who helps you organize your finances and projects the results of your savings and investments

A Data Analyst interprets data and turns it into information which can offer ways to improve a business

A wealth manager is a subset of financial advisor that primarily serves high-net-worth and ultra-high-net-worth individuals

A research analyst is a professional who prepares investigative reports on securities or assets for in-house or client use.

Identify key contacts at potential client companies to establish and foster a relationship

A financial writer creates educational content and/or market commentary for digital and/or print publications.

We are keep close working with industry needs & customized our program

We provide the CWM program in many cities across India. Such professional programs are delivered in 4-6 months and need 6-8 hours each week.

We maintain frequent contact with industry professionals and several recruiters in order to give the greatest possible edge to CWM students.

Industry Expert Faculty

Faculty in CWM Courses are always in need of Industry Experts that can share field insights as well as current trends and advancements in the wealth management or financial planning industry.

Ask Your Query

As a matter of fact you can watch live market trading that helps you to connect with CMT. Join a Technical Analysis Course which works on real time markets by using tools & techniques . That’ll give you behavioural understanding of real time Share market. Understanding the money management by real time trading or investment activity. As we know CMT is an MCQ Exam & ask question on application level. Create short notes of Course Content. Get PPT based Short Notes & note interpretation of tools & Techniques on technical analysis. Short Notes help you out to quick revision at the CMT exam time. CMT Books have very complicated language & course content is not properly aligned as it takes topics from various books of different writers.

So we have to take individual topics and understand concepts in simple, Concise and Clear manner. Take content from various books or websites like Investopedia or Stock Charts on Each Topic for in-depth understanding. Apply tools & techniques with the help of Technical analysis or trading software’s. Read Books twice as MCQ can be created from a single line. while study mark important topics.